Are hemlines and holdings directly proportional?

By ABHINAYA KASAGANI— akasagani@ucdavis.edu

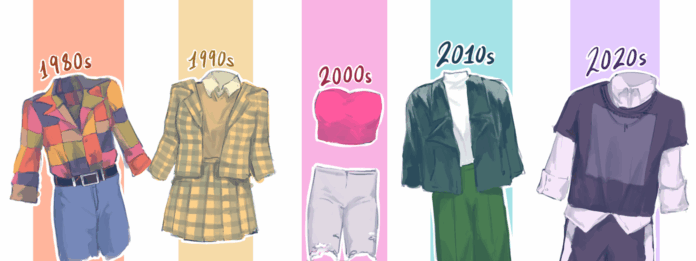

The resurgence in popularity of low-rise jeans and skirts with shorter hemlines may signal the onset of a recession. Much of the conversation online has reframed this trend as a nostalgia-driven revival of Y2K or a rebellion against the body-negativity of the 2010s. Beneath this discourse also lies the economic theory of the “Hemline Index,” which suggests that the lengths of women’s skirts “correlate with the economic conditions [of the time].”

This theory of the Hemline Index was first proposed by economist and Wharton Business School professor George Taylor in 1926, during a time period commonly known as the Roaring ‘20s. His theory suggested that women’s skirt lengths fluctuated in tandem with the stock market. The onset of the Great Depression resulted in skirt lengths that brushed against the floor. Flapper dresses, in all their pomp, glory and circumstance, morphed into longer, conservative pieces during the Great Depression. Although the basis of this theory was regarded as flimsy, financial data has admittedly backed this phenomenon throughout the years.

In support of the Hemline Index, hemlines grew shorter in the mid-1930s and stayed knee-length during the wartime economic boom of the 1940s. Dior’s release of full, voluminous skirts heralded the recession of 1949. The market then moved toward the minis of the 1960s, into the boom of the 1980s (until the stock market crashed in 1987).

In the wake of the 2008 global financial crisis, the market also pivoted toward longer silhouettes — maxi skirts, high-waisted pants, floor-grazing dresses — with Vogue issues littered with hemlines that reflected caution and conservatism. Retail data suggests that shoppers were spending less on fast fashion, favoring articles of clothing that were thought to be long-term investments with less risky and more palatable styles.

However, the Hemline Index is but one theory about consumer fashion trends being reflective of our ever-changing economic atmosphere. Today, shorter hemlines are regaining their popularity, despite the current uncertain economic conditions in the United States. In contrast to the Hemline Index, which claims that shorter skirts signify booming markets, the trend toward mini-skirts seems to reflect the financial instability of this age. Inflation remains obnoxiously high, and major retailers like Target and Macy’s have begun to underperform.

Fashion theorists suggest that shorter hemlines say less about prosperity and communicate more about the psychological urge to lean into maximalism as a form of resistance. Rather than having to relinquish control, wherein one attempts to shield their bodies from policing and guarantees compensation for their work, Americans seem to be embracing shorter skirts in an act of rebellion, contradictory to the predictions of the Hemline Index. Instead of turning to longer, more modest skirt lengths, the resurgence of shorter hemlines symbolizes a desire for unbridled expression.

The 2020s reading of the Hemline Index did not reflect wealth as much as it suggested the anxieties of financial precarity, which was further accelerated by the presence of social media platforms like Instagram and TikTok that rewarded attention-grabbing outfits that led to the rise of “micro” clothing. The conversation surrounding this phenomenon was framed largely around aesthetics, empowerment and Y2K or retro revivals, failing to consider the broader financial factors driving this shift.

The resurgence of low-rise jeans and shorter skirts as indicative of a potential economic recession is a phenomenon that needs to be distinguished from other forms of online discourse. It needs to take into consideration the financial data and theory that have reflected how these instances correlate with measurable shifts in fashion silhouettes — namely, the 1929 stock market crash, the 1973 oil and 1979 energy crisis, the early-1990s recession and the 2008 recession.

Recently, there seems to be a surge in online searches for the sale of micro-skirts and low-rise pants, coinciding with alarming economic forecasts that predict tightening financial conditions. Ultimately, while one should not rely on the Hemline Index as a strict economic indicator, it is an intriguing framework that can offer chances for other fashion theories to take light — namely the one touting mini-skirts as a symbol of the embodied desire for freedom and rebellion — and demonstrate the ways in which fashion and finance work concurrently to reflect the collective economic atmosphere.

Written by: Abhinaya Kasagani— akasagani@ucdavis.edu

Disclaimer: The views and opinions expressed by individual columnists belong to the

columnists alone and do not necessarily indicate the views and opinions held by The California Aggie.